15 Year Fha Streamline Refinance Rates

You ll likely have a lower interest rate.

15 year fha streamline refinance rates. Your combined rate must decrease by at least 0 5. Unlike a traditional refinance an fha streamline refinance allows a borrower to refinance without having to verify their income and assets. Pros and cons of a 15 year fha loan pros. The fha streamline refinance program is a special refinance program for people who have a federal housing administration fha loan.

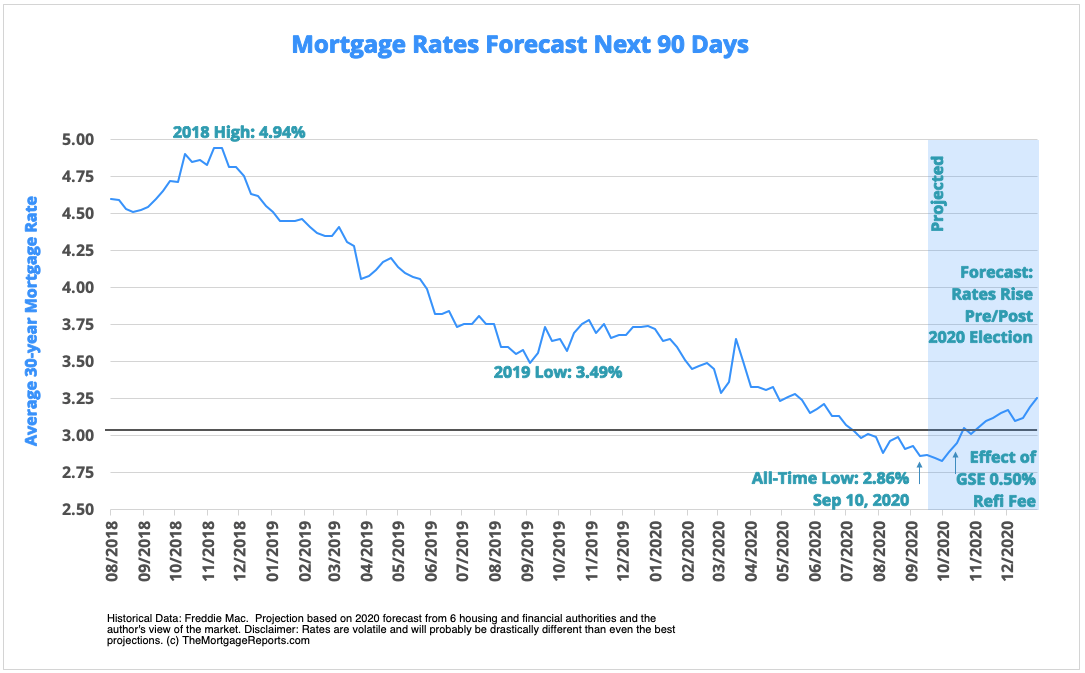

Fha 30 year fixed rate mortgages usually have higher interest rates than 15 year loans. Check fha refinance rates today. Mortgage rates have recently dropped to a level not seen in almost half a century. By refinancing out of a 30 year mortgage and into a 15 year loan the borrower may be eligible for lower interest rates which means that more of the principal loan balance is paid every time you send in your mortgage check.

See the table below for an example of the costs associated with an fha loan versus a 30 year fixed loan. Compare fha refinance rates. Keep in mind interest rates are dependent on the market and the borrower s credit. For example with a minimum 3 5 down payment you d pay 0 70 of your loan amount with a 15 year loan term compared to 0 85 for a 30 year term.

If you re currently in a 30 year mortgage consider the advantages of moving into a 15 year loan. The fha streamline refinance is a great option for current fha homeowners to lower their interest rate and monthly payment. Learn about your fha refi options. 2 2020 the average rate on a 30 year fixed rate mortgage rose one basis point to 2 962 the average rate on a 15 year fixed rate mortgage rose two basis points to 2 533 and the.

Can i refinance my 15 year loan to a 30 year loan. But those who get into a 30 year mortgage still have the option to refinance into a 15 year fha loan at another point. Compare 15 year mortgage rates when you refinance. Fha refinance loans near 50 year lows.

The fha does not allow reducing your loan term with a streamline refinance. An fha streamline is a great way to take advantage of historically low interest rates and lower your monthly payment because the process is simpler than what is required by most refinance programs unlike a conventional refinance an fha streamline refinance may not require you to submit income documentation or get an appraisal. An fha refinance loan is a refinance insured by the federal housing association. Check our rates and lock in your rate.

Save money by comparing free customized 15 year mortgage rates from nerdwallet.