1031 Exchange Renovations

Inform closer that the sale involves a 1031 exchange and that equity advantage will be contacting them shortly.

1031 exchange renovations. You should always seek the advice of your legal financial and tax counsel before entering into any improvement exchange transaction. Due to irs restrictions construction exchanges are often not your best option. Is an assistant vice president for investment property exchange services inc the country s largest qualified intermediary and full service exchange accommodation titleholder. One year after acquisition you sell the property for 200 000 with a gain at sale of 50 000.

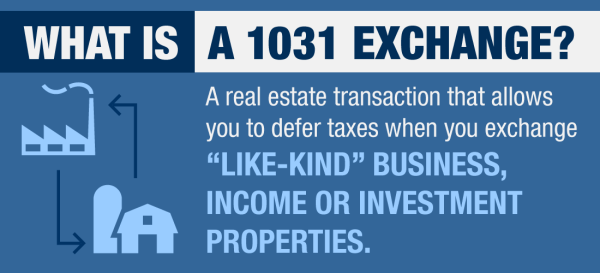

The term which gets its name from irs code section 1031 is. 1 to put it simply this strategy allows an investor to defer paying capital gains taxes on an investment property when it is sold as long another like kind property is purchased with the profit gained by the sale of the first property. 50 years and numerous 1031 exchanges later you ve worked your way. Exeter 1031 exchange services llc is always available to work with you and your advisors in planning your improvement 1031 exchange.

We ll discuss like kind property in more detail in section four. So we created this guide to help you navigate 1031 construction rules. Greg can be reached at 866 443 1031 to answer questions about this article or any exchange topic. The term 1031 exchange is defined under section 1031 of the irs code.

In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. This is sometimes referred to as the qualified purpose. Contact your closing agent provide purchase information. Here s how with a build to suit or property improvement exchange you can include the cost of improvement in a 1031 exchange.

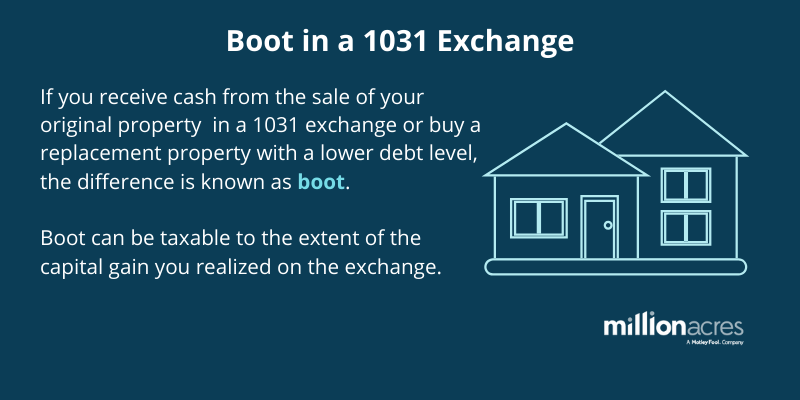

Improvement 1031 exchange transactions are complex tax deferred strategies. After 50 000 in renovations the new value of the property is 200 000. In order to qualify for non recognition of gain under an internal revenue code section 1031 exchange also called a like kind exchange both the property that you give up the relinquished property and the property you acquire the replacement property must be property held for productive use in a trade or business or for investment. Rather than pay capital gains tax on 50 000 you execute a 1031 exchange into a 200 000 value add fourplex.