10 Year Fixed Rate Mortgage Australia

However for those who can afford the slightly higher payment associated with a 10 year mortgage are getting a better deal in almost every possible way.

10 year fixed rate mortgage australia. A 10 year fixed rate mortgage is a home loan that can be paid off in 10 years. Find out whether this option could be suitable for you. 10 years is one of the longest terms available for fixed rates in australia. Compare 10 year mortgage rates and find your preferred lender today.

This means a 10 year fixed rate loan for example must be paid in full by the end of the 10 year loan term. This comes after a number of years of federal government scrutiny over the cmhc with previous finance minister jim flaherty musing publicly as far back as 2012 about privatizing the crown firm. The rate is calculated using an industry wide formula based on a 150 000 loan over a 25 year period and includes things like revert rates after an introductory or fixed rate period application fees and monthly account keeping fees. Advantages of a 10 year fixed rate home loan.

As such the regular repayments on a shorter fixed term are much higher than on a. Though you can get a 10 year fixed mortgage to purchase a home these are most popular for refinances. 10 year fixed rate home loans in australia ten years is considered a relatively long period to fix your home loan. Topic to neighborhood legal requirements the residential property might after that be sold.

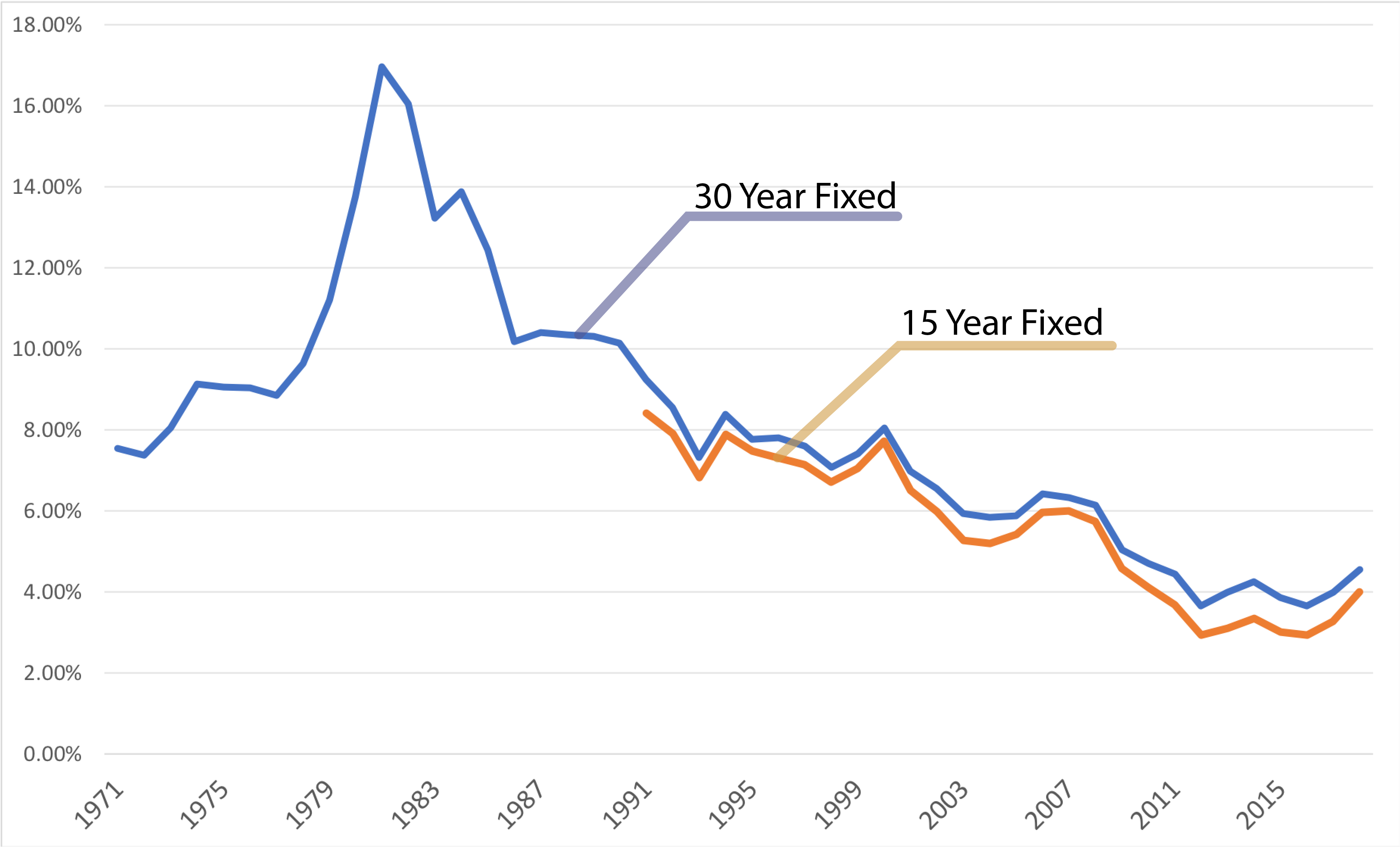

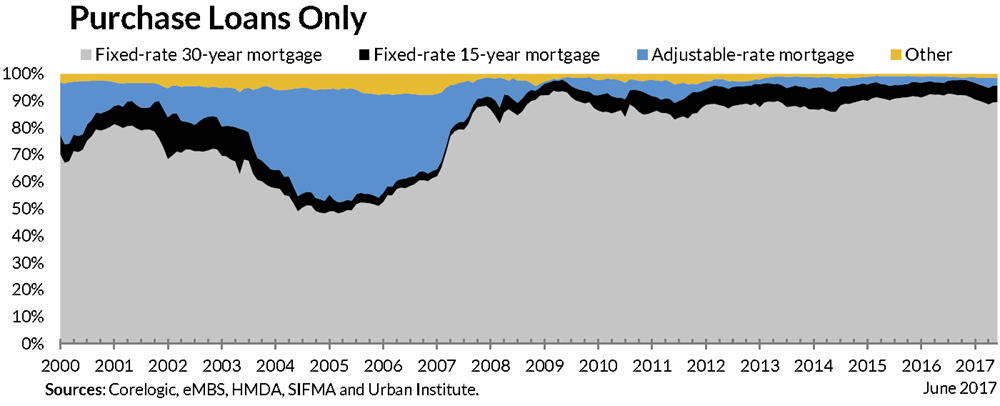

In australia it is more common to find fixed loans with a fixed rate term of 1 year up to 5 years which reverts to a variable rate after the fixed term ends. There isn t too much that is different between a 30 year fixed rate mortgage and other fixed rate mortgages except that the fixed term is so much longer. Why fix for 10 years. For example on a 200 000 15 year fixed rate loan at 4 percent you would pay 66 287 in total interest but with a 10 year loan at 3 75 percent you would save 26 140 in interest and five years of loan payments.